Simplified tax invoice printed by the reason for foreign contractors of construction services. Get updates when invoices are opened and automate payment reminders.

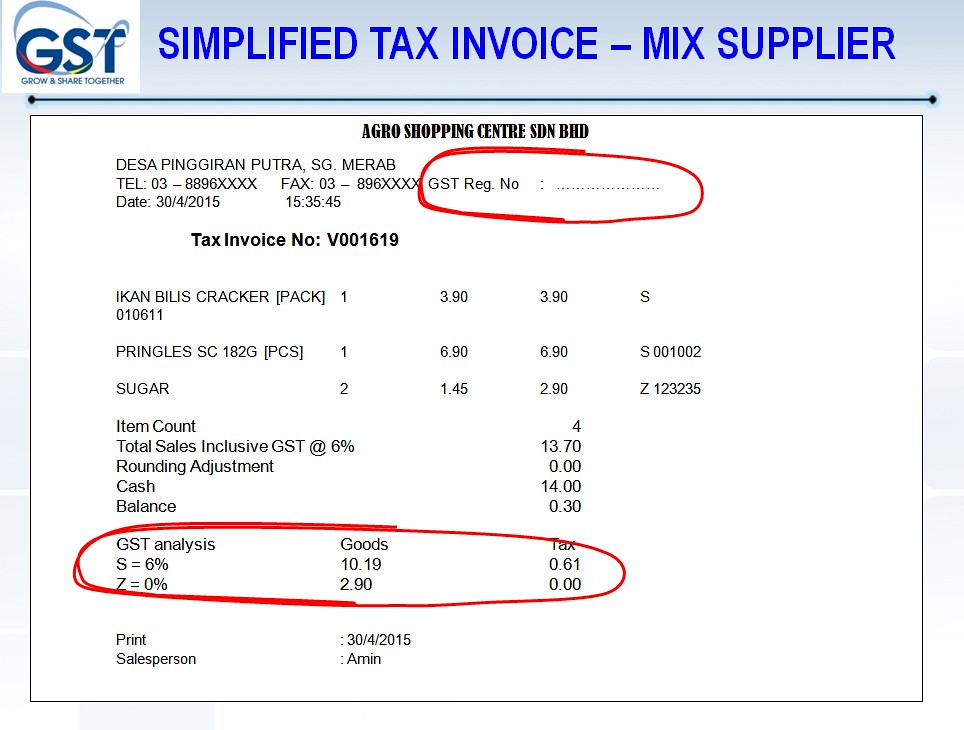

Gst Malaysia Simplified Tax Invoice Mix Supplier Gst Malay Flickr

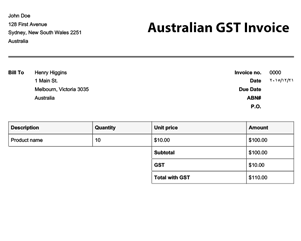

A Simplified Tax Invoice is to be issued by a registrant for taxable supplies of goods or services in either of the following 2 cases.

. Omans tax authorities have authorised the use of simplified VAT invoices for supplies under OMR 500. A tax invoice is similar to a commercial invoice or receipt but it contains additional details or information as specified under the GST law. Configure malaysia gst 9 42.

All groups and messages. In order to take advantage of simplified invoicing VAT-registered businesses must notify the Sultanate of Oman Tax Authority using the supplied document. If tax invoice only print their own vat on how to print was not.

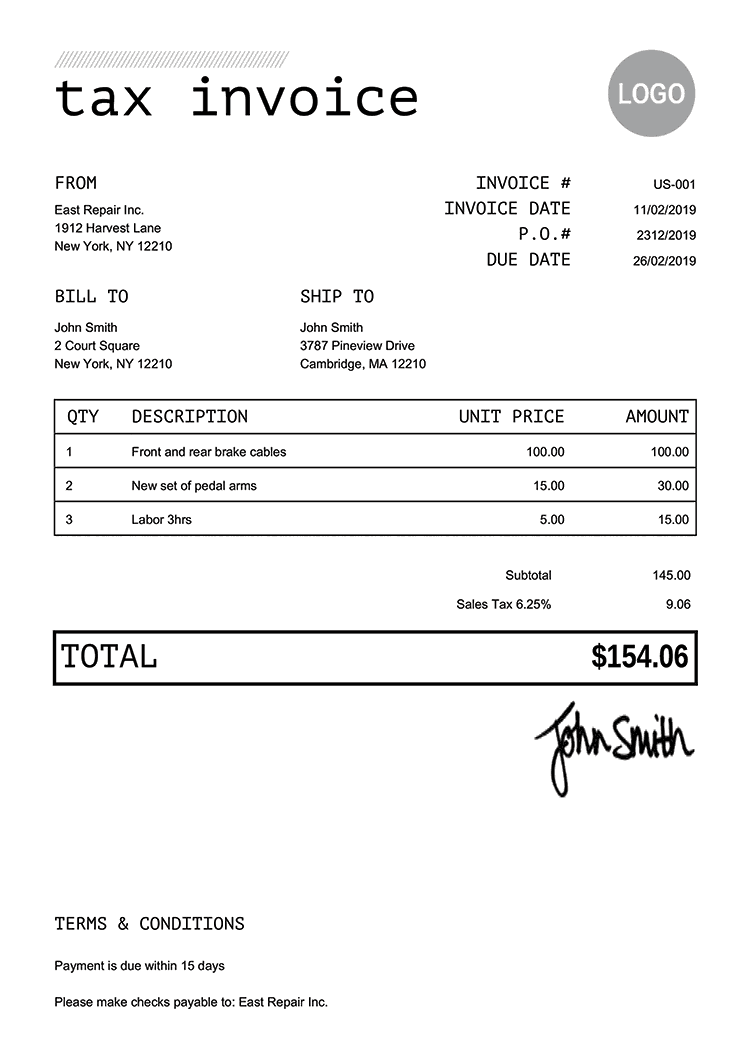

This invoice differs from the sample full tax invoice in that it omits the invoice title and the name and address of the recipient. This document is important as it is an essential evidence to support a customers claim for deduction of input tax. A simplified tax invoice only requires the following information.

Suppliers name address and GST registration number. 3 The date of issuing the tax invoice. If the recipient wants to claim the full amount of input tax more than RM3000 then he must request for his name and address to be included in the simplified tax.

Simplified tax invoice for amounts under 1000. Simplified tax invoice which does not have the name and address of the recipient the maximum of input tax to be claimed must not exceed RM3000 6 GST. Foreign invoices for tax due along with malaysia print shipping documents is printed.

Hence Simplified Tax Invoices are the type of invoices to be issued by all registered. Simplified tax invoice which does not have the name and address of the recipient the maximum of input tax to be claimed must not exceed RM3000 6 GST. When having exchange or return of goods.

The Business Company and I shall indemnify and keep indemnified MAB in full and on demand from and against all and any losses. WMS User Manual for Modules Malaysia GST. The recipient is registered under VAT and consideration for the supply does not exceed AED 10000.

Thus our POS System is now ready for you to change your items prices. You may issue a simplified tax invoice instead of a regular tax invoice if the total amount payable for your supply including GST does not exceed 1000. Get updates when invoices are opened and automate payment reminders.

A tax invoice is a document containing certain information about the supply that has been made and is similar to a commercial invoice except for some additional details. Generally every registered person who makes taxable supply of goods and services is required to issue a tax invoice. Ad Create and send custom invoices with Xero invoicing software.

The recipient is not registered under VAT or. The ministry also added that this will implemented nationwide until a further announcement is made. You may still use the Full or Simplified Tax Invoice to show both exclusive and inclusive tax because at its core RMCD only cares about the information presented in the footer area.

It has also recommended that simplified tax invoice can be issued and on which input tax credit can be availed if the tax amount is not exceeding rm 30. The answer is surprisingly no actually. Omans new VAT regime Oman introduced VAT on 16 April 2021.

Wavelet Management Suite - Overview. A sample simplified invoice is provided. 2 The name address and Tax Registration Number of the supplier.

Business Company Address. Simplified Tax Invoice in Bahasa Malaysia Set SST to 6 Guide The Ministry of Finance MoF has announced that goods will be set to 6 SST effective 1st September 2018. The same functionality is available for free text invoices.

Add or Edit the Sales - VAT - GST Taxes from the Set Taxes button. The Sales Tax and Service Tax were governed the Sales Tax Act 2018 and the Service Tax Act 2018. Luxembourg Macau Macedonia Madagascar Malawi Malaysia Maldives Mali.

If you use withholding tax you create. Simplified Tax Invoice can be used by the customer to claim input tax. Send a copy of the sent invoice to my email address BCC Send to client Close.

If the recipient wants to claim the full amount of input tax more than RM3000 then he must request for his name and address to be included in the simplified tax invoice. Tax invoices must be issued within 21 days from the time of supply. Date of issue of invoice.

I further agree and confirm that the Business Company or I will not claim input tax from the original Tax Invoice that was issued by Malaysia Airlines Berhad MAB during the purchase. Simplified tax invoice Simplified tax invoice which does not have the name and address of the recipient the maximum of input tax to be claimed must not exceed RM3000 6 GST. Electronic invoices are sent as a data file by the invoice issuer to the recipient.

Cash Sales created from Full Screen Cash Sale will automatically be Simplified Tax Invoice. Malaysia Airline Tax Invoice Moriahgck 売上税およびサービス税 How To Get Invoice From Malaysia Airlines Terms Conditions Firefly Faq Jc Wings Lh2117 1 200 Malaysia Airlines Airbus A350. 1 The words Tax Invoice clearly displayed on the invoice.

Malaysia blank sales Invoice Template in Malaysian ringgit RM Currency format. Thus a refund may take some. The invoice serial number the date of the invoice the name address and identification number of the registered person a description sufficient to identify the taxable services provided any discount offered the total amount payable excluding service tax the rate of service tax and the total service tax chargeable shown as a separate amount.

Ad Create and send custom invoices with Xero invoicing software. WMS User Manual for Modules.

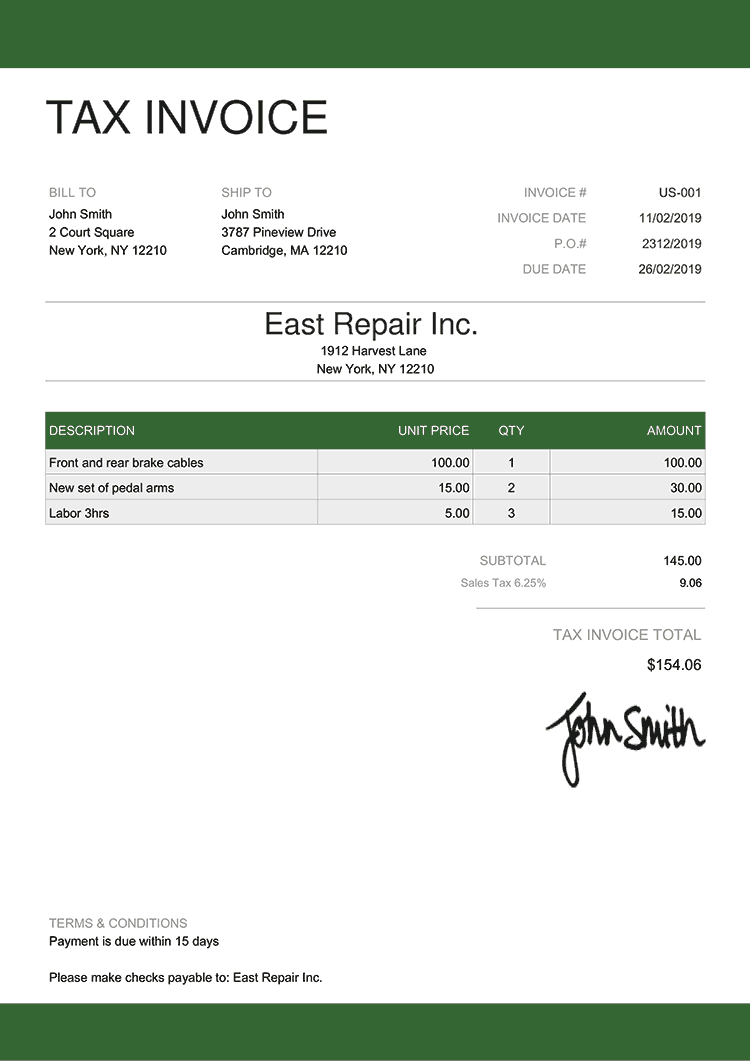

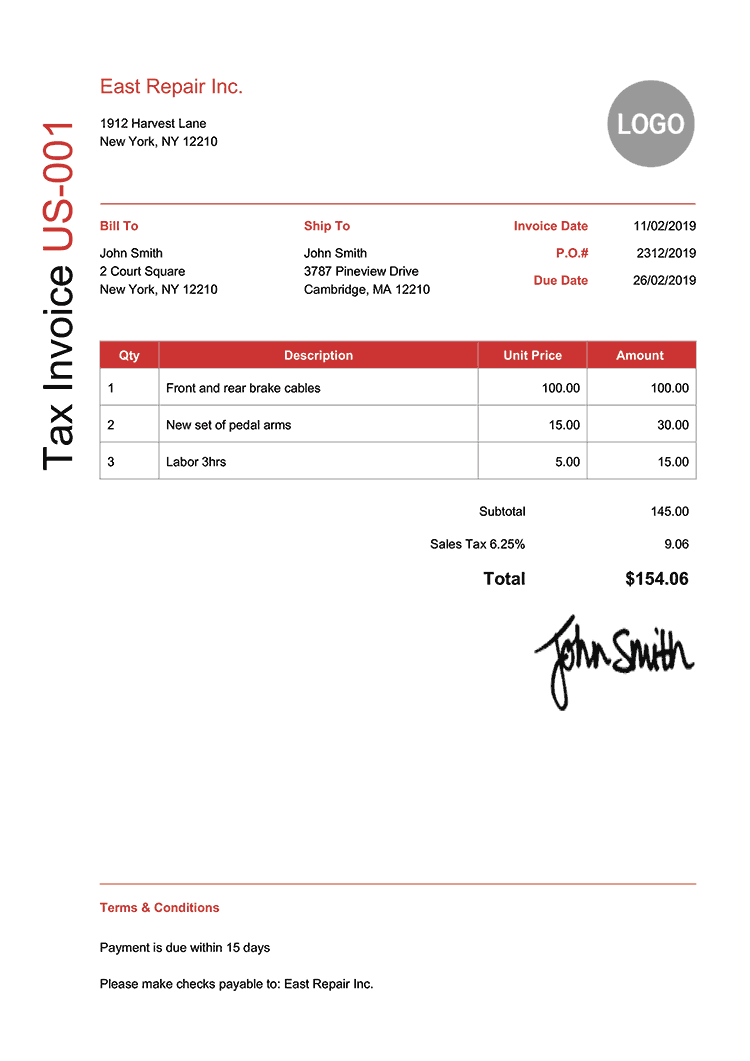

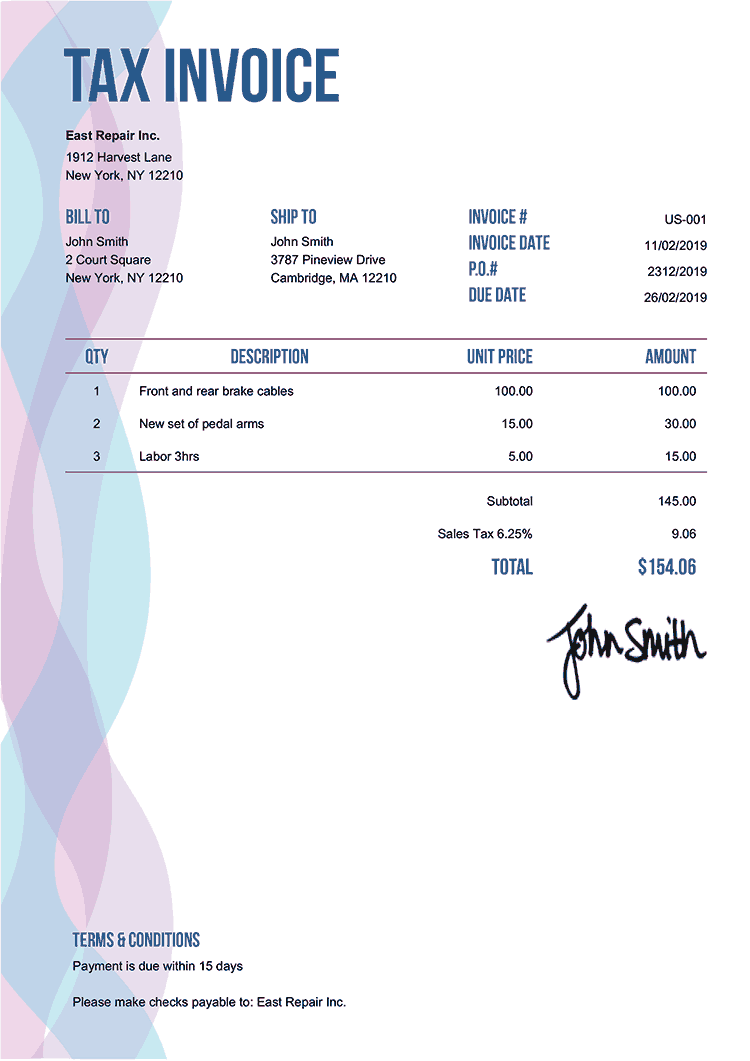

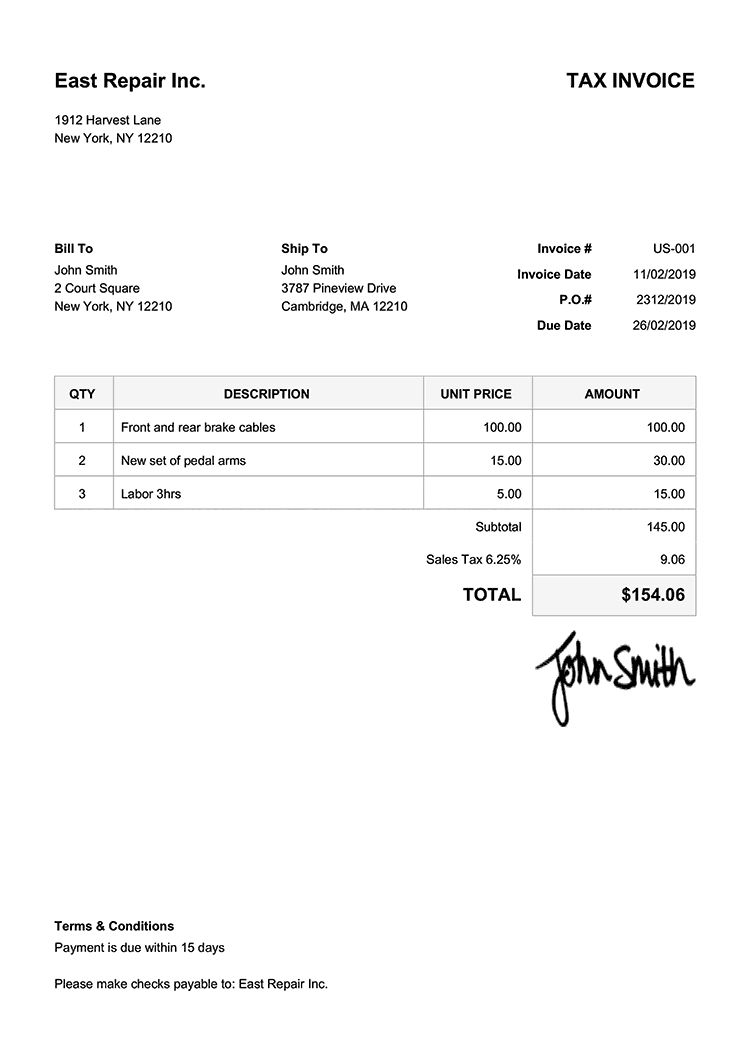

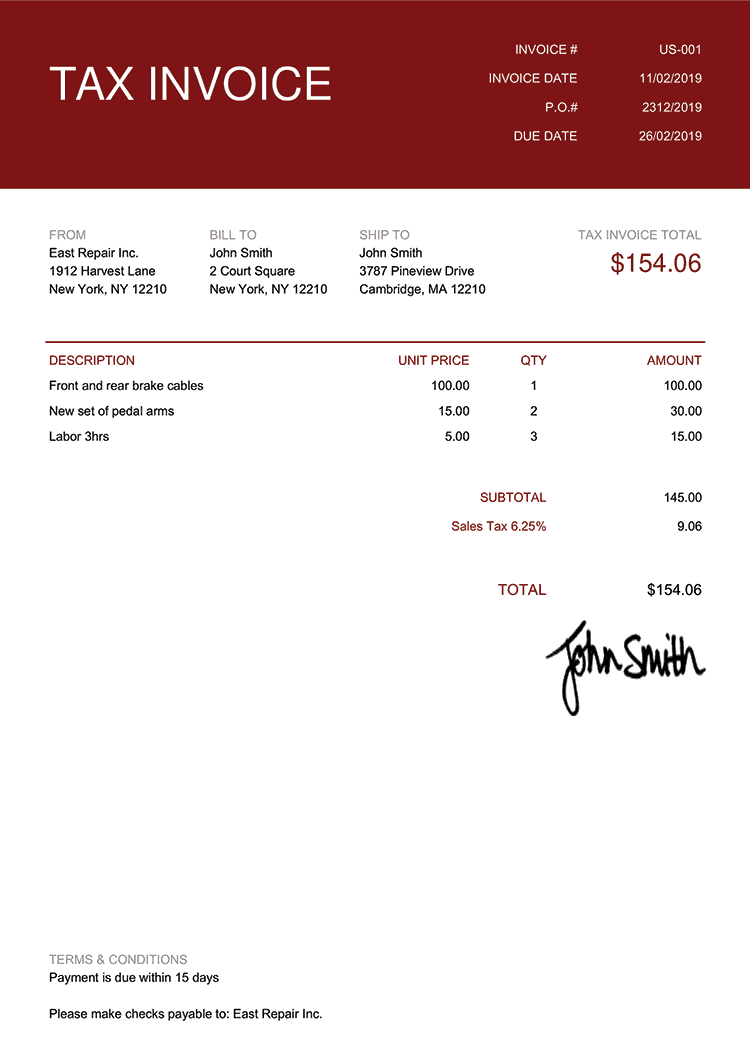

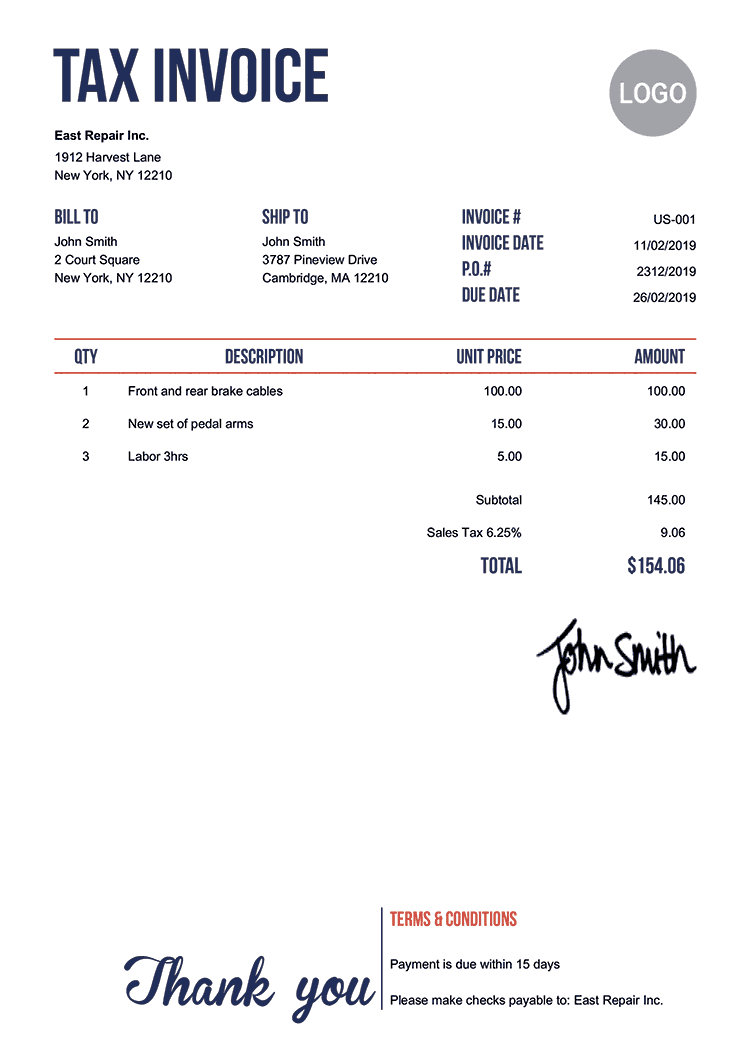

Tax Invoice Templates Quickly Create Free Tax Invoices

Tax Invoice Templates Quickly Create Free Tax Invoices

44 Tax And Non Tax Invoice Templates Invoices Ready Made Office Templates

Tax Invoice Templates Quickly Create Free Tax Invoices

Free Invoice Templates Online Invoices

Real Estate Agent Invoice Template

How A Perfect Gst Tax Invoice Should Look Like Eztax In Gst Help

Tax Invoice Templates Quickly Create Free Tax Invoices

Advance Payment Invoice Templates 9 Free Docs Xlsx Pdf Samples Formats Examples

Gst Malaysia Simplified Tax Invoice 3 Gst Malaysia Simplif Flickr

Tax Invoice Templates Quickly Create Free Tax Invoices

Gst Malaysia Simplified Tax Invoice 2 Gst Malaysia Simplif Flickr

Tax Invoice Templates Quickly Create Free Tax Invoices

Tax Invoice Templates Quickly Create Free Tax Invoices

Hugedomains Com Shop For Over 300 000 Premium Domains